New information share agreement aims to increase visibility in fuel bunker pricing and improve decision making around the viability of using LNG to power fleets

Leading independent provider of information, analytics and benchmark prices for the commodities and energy markets, S&P Global Platts (“Platts”) and SEA-LNG, the coalition for accelerating LNG as a marine fuel, have today announced a new collaboration to improve the visibility of LNG fuel pricing.

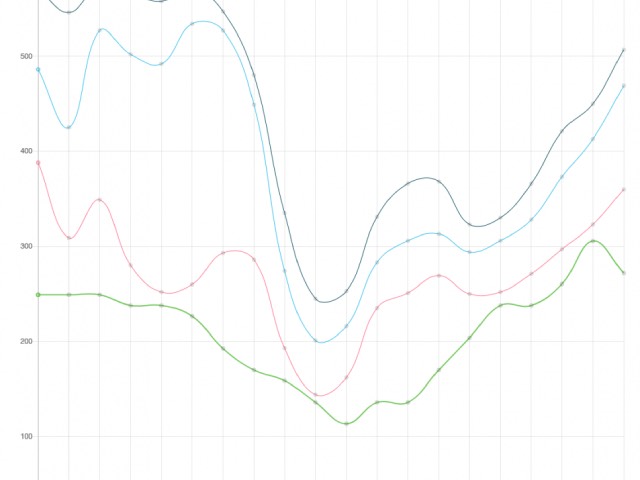

Under the terms of the agreement, SEA-LNG will display monthly averages of Platts’ daily LNG bunker price assessments on its refreshed website, as well as Platts’ fuel oil bunker assessments. By providing greater transparency of trends and comparisons between conventional and LNG marine fuels in the key bunkering hubs of Rotterdam and Singapore, the organisations hope to support operator’s decision making around fuel choices for their fleet.

The collaboration comes as both organisations continue efforts to facilitate increased transparency in fuel bunker pricing, and in particular support the development of a global LNG marine fuel value chain for shipping’s transition to a more sustainable future.

“We are excited that our new collaboration with SEA-LNG will add further transparency to the growing LNG bunker spot market,” said Kenneth Foo, Managing Editor, APAC LNG at S&P Global Platts commented. “Platts provided the world’s first daily valuation of LNG bunkers in September 2019. This agreement provides strong validation of the importance of our independent price assessments to markets — allowing shippers and buyers and sellers of LNG to make informed decisions by evaluating Platts’ LNG bunker assessments, alongside the value of traditional marine fuel bunkers on SEA-LNG’s website.”

SEA-LNG General Manager Steve Esau stated: “S&P Global Platts has a long history of facilitating the development of new spot markets. Through this collaboration, we are pleased to make available an additional market data point to participants wanting to understand the commercial outlook of LNG as a marine fuel, in addition to its environmental and operational benefits.