Allianz Safety and Shipping Review identifies loss trends and highlights coronavirus, climate, security and technology-related challenges for the maritime sector.

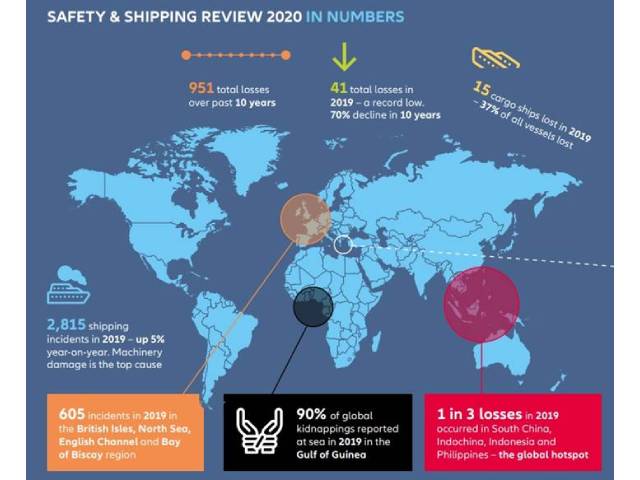

Given the global shipping industry is responsible for transporting as much as 90% of world trade, the safety of its vessels is critical. The sector saw the number of reported total shipping losses of over 100GT decline again during 2019 to 41 – the lowest total this century and a close to 70% fall over 10 years. Improved ship design and technology, stepped-up regulation and risk management advances such as more robust safety management systems and procedures on vessels are some of the factors behind the long-term improvement in losses.

Shipping losses declined by almost a quarter year-on year from 53 in 2018, although late reported losses may increase the 2019 total further in the future. Bad weather was reported as a factor in one in five losses. The 2019 loss year represents a significant improvement on the rolling 10-year average of 95 – down by over 50%.

South China, Indochina, Indonesia and the Philippines maritime region remains the main loss hotspot, accounting for almost 30% of losses over the past year with 12 vessels. These waters are also the major loss location of the past 10 years, driven by factors including high levels of local and international trade, congested ports and busy shipping lanes, older fleets, exposure to typhoons and ongoing safety problems on some domestic ferry routes.

However, the number of losses in this region has declined for the second successive year. The Gulf of Mexico (4) and the West African Coast (3) – neither of which featured in the top 10 loss regions last year — rank as the second and third most frequent loss locations.

Cargo vessels (15) accounted for more than a third of all total losses during 2019 with the majority occurring in South East Asian waters. The number of losses involving ro-ro vessels (3) increased year-on-year. Foundering is the most frequent cause of loss of all vessels, accounting for three in four during 2019. Contributing factors included bad weather, flooding and water ingress, engine trouble and vessels capsizing. Fire/explosion continues to be a significant problem onboard vessels, resulting in five total losses during 2019.

While total losses declined significantly over the past year, the number of reported shipping casualties or incidents actually increased by 5% to 2,815. There were over 1,000 cases of machinery damage/failure (1,044) – already the top cause of shipping incidents over the past decade – accounting for more than one-third of all incidents reported in 2019.

Incidents on passenger vessels and Ro-Ros increased. The British Isles, North Sea, English Channel and Bay of Biscay maritime region replaced the East Mediterranean to become the main incident hotspot for the first time since 2011, accounting for one in five incidents (605).

***

CORONAVIRUS IMPACTS

The shipping industry has largely proved resilient to the coronavirus outbreak, keeping the life blood of global trade and essential supplies flowing. However, while many of the risks of the sea have been reduced for those vessels waiting at anchorage or in lay-up – the reduction in sailings could be a positive for claims frequency – new challenges have evolved. One of the biggest issues has been the inability to change crews easily because of pandemic restrictions. Relief of crew is essential in ensuring the safety, health and welfare of seafarers. Extended periods on board vessels can result in mentally and physical fatigued crew, which is known to be one of the underlying causes of human error, estimated to be a contributing factor in 75% to 96% of marine incidents.

The sustained economic downturn will have implications for shipping risks , as vessels are laid-up and companies take steps to manage costs. Past downturns have shown that crew and maintenance budgets are often among the first areas to be cut. It is important that the industry does not undo its good work of previous years and let safety and risk management standards slip.

Damaged goods and containers is already one of the most frequent causes of insurance claims in the shipping industry, accounting for more than one in five claims, according to AGCS analysis and the pandemic has heightened the risk environment around high-value and temperature-sensitive goods in particular as supply chains have come under pressure, cargo-handling companies have shut down abruptly and ports operated under restrictions.

The coronavirus outbreak has also made it difficult for vessels to obtain essential spares and consumables, such as oils and lubricants, and carry out maintenance and repairs. This could have a detrimental effect on the safe operation of engines and machinery, potentially causing damage or breakdown, which in worst-case scenarios can lead to groundings or collisions. The cruise ship industry, which generates more than $150bn in global economic activity and supports over one million jobs worldwide, effectively went into hibernation as a result of the pandemic. With the biggest cruise ships worth in excess of a billion dollars, accumulations of risk are a potential issue while restrictions are still in place. As of April 2020, some 95% of the global cruise fleet was in lay-up, with many vessels anchored in hurricane-exposed areas in North America and typhoon-exposed areas in Asia. Emerging from lay-up poses another challenge. The monthly cost of cruise ship lay-up can be in the millions of dollars and the extent of upkeep and crewing will affect the speed with which a vessel can be brought back into service.

As the price of oil plummeted amid concerns for the coronavirus economy, demand for floating storage hit record levels. Many tankers have been idling around major oil ports and terminals in the US, Europe and Africa, with potential exposures to extreme weather, piracy and political risks. Tankers have also been chartered for use as floating storage, which will need to be subject to certain maintenance and contractual requirements.

LOSS TRENDS IN FOCUS

Issues with car carriers and ro-ro vessels remain among the biggest safety issues for the shipping industry. The number of total losses involving ro-ros has increased year-on-year, while reported incidents (188) are up by 20%. These, and similar vessels, can be more exposed to fire and stability issues than others, and can require additional emphasis on risk management. Many can have quick turnarounds in port and a number of accident investigations have revealed that pre-sail away stability checks were either not carried out as required or were based on inaccurate cargo information. In many cases cargo was not fully-secured prior to sailing.

While major losses have trended down, attritional claims are becoming more of an issue for insurers, in part due to increasing complexity. Litigation, particularly in the US, can drag on, while any environmental issues can also take time to resolve, adding significantly to claims costs. In addition, the frequency of higher value claims has been rising, as has severity from navigation and machinery issues.

Container ship fires continue to be an issue. Vessels become larger every year – capacity has increased by 1,500% over 50 years – which can impact fire prevention and salvage in the event of an incident. Awareness of this problem has been growing, but is still a major concern and a focus of insurers. Technology could play a role in reducing the risk of fire on board vessels, including temperature monitoring of cargo, water spray and CO2 fire suppression in cargo holds, more active firefighting on deck, including water curtains, water screens and fixed water monitors and even integrating fire suppression systems in drones.

A National Cargo Bureau (NCB) study found the majority of containers it inspected had issues with mis-declared or improperly stowed cargo. Of the 500 containers inspected, more than half failed with one or more deficiencies, including the way cargo was secured, labelled or declared. This is an issue that needs to be addressed by the whole supply chain. Too much cargo is being loaded that is not properly documented and appropriately stowed, increasing the threat of fires and risking lives. In response, a number of major container ship operators are taking steps to tackle the issue, including more stringent cargo verification and inspections and higher penalties and fines for infringements. Technology and machine learning is also increasingly being deployed to help better review cargo manifests and identify issues. However, this is a problem that will only get worse if action doesn’t continue, as vessels become bigger and the range of goods transported continues to grow. Chemicals and batteries are increasingly shipped in containers, and these pose a serious fire risk if they are misdeclared or wrongly stowed.

CLIMATE CHALLENGES

From January 1, 2020, allowable sulphur levels in marine fuel oil were slashed under the International Convention for the Prevention of Pollution from Ships (MARPOL) Annex VI, more widely-known as IMO 2020, as the shipping industry looks to plays its part in a more sustainable environment. However, compliance with the new sulphur cap is not straightforward, with a range of options available – each with its own cost implications, compliance challenges and risks.

The sulphur cap creates uncertainty for risks of bunkering, machinery breakdown and the use of scrubbers, which are used to remove harmful materials from industrial exhaust gases before they are released into the environment. Insurers are concerned that teething problems with scrubbers could lead to a surge in machinery damage claims, with technical and operational issues already having resulted in a number of losses. Scrubber waste is corrosive and there have been reports of incidents where this corrosion has caused wastewater to flood engine rooms, ballast tanks and cargo holds. Further losses related to scrubbers and bunker fuels are likely to materialize in the months and years ahead.

Targets to cut emissions will shape risk for the shipping industry for years to come. The International Maritime Organization proposals to halve CO2 emissions by 2050 is a challenging target to achieve, and one that will require the industry to radically change fuels, engine technology and even the design of vessels. In addition to the technical challenges, decarbonization will have regulatory, operational and reputational (corporate social responsibility) implications for shipping companies. Investors are increasingly shunning carbon-intensive industries, while regulators and investors are insisting on more transparent reporting of climate change risks and exposures. However, there is the risk that all the progress on addressing climate change could now stall with the focus on the coronavirus pandemic. This must not be allowed to happen.

The impact of more unpredictable weather is already manifesting in claims activity. Record water levels on the Mississippi river in 2019 resulted in damage to vessels and shore side infrastructure, as well as causing major disruption for supply chains. Such events are likely to have a greater impact on trade and claims in future.

SECURITY PROBLEMS

Political risk has become a pressing topic for the shipping industry, with trade wars, regional conflicts, civil unrest and piracy all impacting. Shipping is a global commodity and can be used as a pawn in disputes due to its impact on the economy.

Shipping companies should prepare for an increase in disruption to supply chains and their operations in future. Political rivalries are increasingly being played out on the seas, affecting some of the world’s busiest transit routes. Tensions between the US and Iran have led to a growing number of attacks against vessels in the Gulf of Oman and off the coast of Yemen. There is already only a small window of error when navigating a choke-point like the Strait of Hormuz and such security challenges put more pressure on crews and a financial burden on shippers. In addition to physical damage from attacks targeting vessels, there is the potential knock-on effect of a heightened risk of collisions and groundings. The South China Sea, where China and the US are vying for influence in Asia Pacific, is fast becoming another hotspot.

Heightened political risk globally raises the threshold for unrest, with other implications for shipping, such as the ability to secure crews and access ports safely.

Piracy remains a major risk for shipping. In 2019, there were still 162 incidents of piracy and armed robbery against ships worldwide, albeit down from 201 in 2018, according to the International Maritime Bureau. The Gulf of Guinea accounted for 90% of global kidnappings reported at sea in 2019 with the number of crew taken increasing by more than 50%. Such activity continued through the first few months of 2020. Latin America has also seen a rise in piracy and armed robbery. Given the heightened political and economic uncertainty in the world today, piracy is a threat that is likely to remain, if not increase.

TECHNOLOGY DEVELOPMENTS

Vessels are becoming more connected to shorebased systems, meaning the cyber threat is ever-evolving – from crippling ports and terminals to spoofing attacks on ships. The coronavirus outbreak is impacting too, with reports of companies having faced a 400% increase in attempted cyber-attacks since the pandemic began. Ship-owners are also increasingly concerned about the prospect of conflicts. As modern vessels become increasingly dependent on computer and software, and with heightened geopolitical risks, the threat of cyber to the shipping industry is significant.

The way in which vessels and crew are interacting with technology has become a significant factor in collisions and groundings. Last year, the US Navy said it was to replace touch screens with manual controls in 2020 after an investigation into an incident involving one of its vessels in 2017 which resulted in fatalities.

When used appropriately technology can improve shipping safety and better training and utilization of data can result in more successful integration. In particular, the industry needs to start learning from successful journeys, not just accidents. Such insights can be used to develop new technology, inform training and improve crew and safety culture.

Increased use of industrial control systems (ICS) to monitor and maintain engines could lead to a significant reduction in machinery breakdown incidents in future. Over the years, the shipping industry has moved from timebased maintenance to condition-based maintenance, and with digitalization, it will shift towards predictive or preventative maintenance.

In time, the move to preventative maintenance could improve the reliability of engines and ultimately improve safety. At present, human error is a big factor in machinery breakdown losses. Even a well-trained crew can make mistakes which can result in damage, so real-time onshore monitoring, by owners in consultation with manufacturers, and preventative maintenance could reduce such incidences.