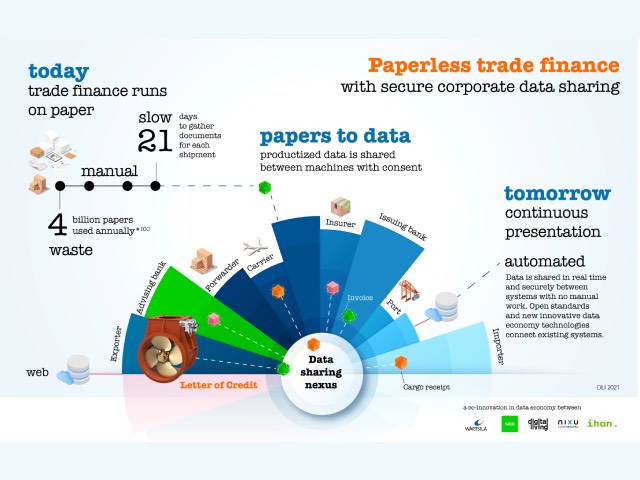

The technology group Wärtsilä has participated in an innovative co-creation project aimed at digitalising the Export Letter of Credit (L/C) process, which currently is handled manually and by email using paper documents and PDF files. The results of the experiment indicated clearly that physical documents can easily be replaced with secure and standardised data sets that enable automated processing. This is considered a breakthrough achievement.

In addition to Wärtsilä playing the role of an exporter, the other companies participating were SEB, acting as the L/C advising bank, Digital Living International which implemented the fully digital L/C document exchange based on Finnish Innovation Fund Sitra’s data sharing platform called IHAN testbed, and Nixu Corporation which supported the process with its cyber secure digital identity and security solutions. The purpose of the experiment was to show that corporate data sharing can be executed technically, functionally, with good governance, and without the fear of critical business information being misused.

“Wärtsilä is actively and continuously exploring opportunities to raise efficiency levels in all its activities, processes and dealings. As a global company, we are constantly handling commercial transactions with customers and banks around the world, and this experiment involving collaboration with qualified partners seeks to not only increase the efficiency of these dealings, but also to mitigate possible risk,” says Jarmo Nurmi, Corporate Treasurer at Wärtsilä.

The participating co-creators point out that a data-based system will make smoother market practices available, and that it is easy to implement and integrate with standard and open application programming interfaces (APIs) controlled by the data sharing and consent management mechanism. This eliminates the fear of data copying and its use without consented access.

The project was commenced in 2020 with planning based on design-thinking. While the experiment could only cover part of the overall L/C process, it was nevertheless able to determine that automated processing is possible within Trade Finance stakeholder systems. It also proved that this can be done in a platform, system, and process agnostic manner which can be gradually extended.

More detailed results of the experiment are available in this pdf file.